Nobilis Global

It's time to rediscover your investment lifestyle with Nobilis Global.

With us you will enter a private network that's lead by industry titans, gain exposure to world-class deals, and achieve a level of financial success that will leave an enduring mark on the world.

About Us

Nobody Controls the invisible hand, for the present is the only certainty we possess.

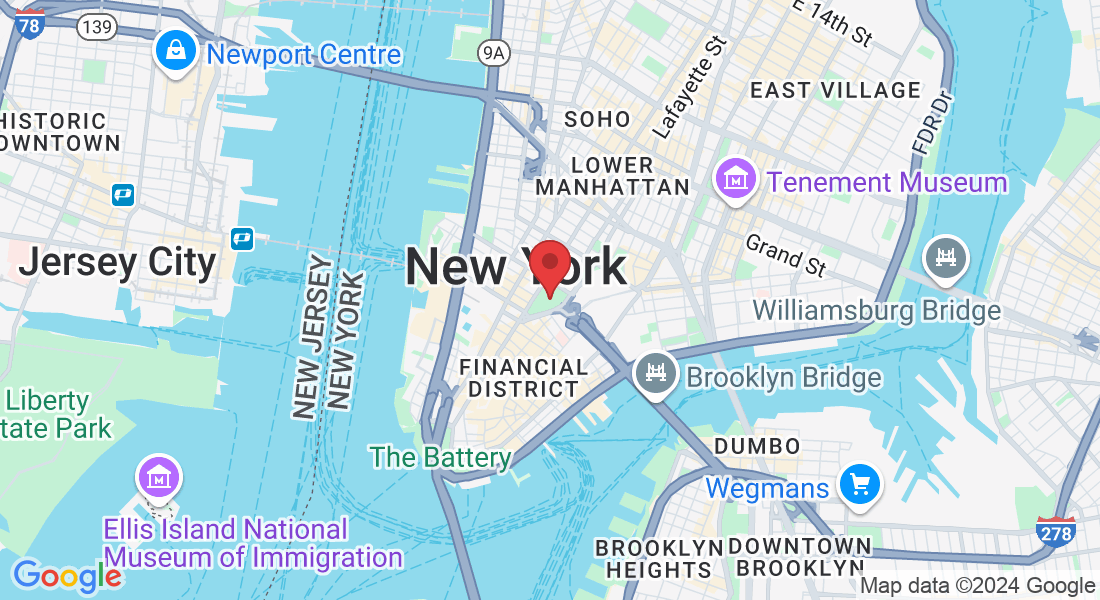

In the realm of global finance, our boutique investment firm shines as a beacon of excellence. We deftly navigate the intricate landscape of private equity and venture capital, guided by a discerning methodology that elevates us above the commonplace. With a strategic presence in key global centers, we stand at the forefront of project funding and consultancy services.

Our clientele comprises an elite group of visionaries who shape the very contours of industry and commerce. We meticulously tailor bespoke financial solutions to harmonize with the unique aspirations of each distinguished client. Exceeding expectations is our benchmark as we propel our clients towards the pinnacle of success.

In a world often mired in mediocrity, our firm embodies a legacy of unrivaled wisdom spanning over a century. We illuminate the path for the truly exceptional, guiding them to their rightful place at the zenith of achievement. More than mere consultants, we are the architects of financial destinies, the stewards of prosperity, and the unseen catalysts behind some of history's most coveted endeavors.

Our placement services extend beyond traditional financing options, encompassing a wide range of alternative solutions including:

Full-Service Boutique Investment Banking

Special Structured Offerings Qualification

Fully Operating Petro Desk, Banking Instruments, Off-to-On Ledger Receivership, Monetization Capabilities;

Commerical Real Estate and Mega-Commercial Projects(CRE) Full Cap-Stack;

Structured Finance;

Ground Leases;

Mezzanine Financing;

Custom and Traditional Debt;

C-PACE;

Grants and Subsidies;

Tif's;

HTC's;

OZ's;

Bridge Loans: Merchant Cash Advance (MCA), Accounts Receivable (AR), Purchase Order (PO), Lines of Credit, Warehouse Lines, Trade Finance, Equipment Financing;

Sovereign Guarantees, Resource Guarantees, Corporate Guarantees;

Convertibles, Venture and Complex Debt Financing, Carve-Outs, Private Equity;

Equity Infusions;

GP / LP;

Joint Ventures;

Credit Facilities;

Credit Enhancements and Swaps;

Derivatives and Debentures;

Mergers and Acquisitions; as well as high-level structured

(or re-structure) finance

Mission

Nobilis Global seeks to optimize client wealth through strategic allocation of capital into world-class investment opportunities. We focus on identifying and executing transactions with potential for significant value creation and transformative impact. Our approach leverages proprietary deal sourcing, rigorous due diligence processes, and innovative financial structuring to deliver superior risk-adjusted returns while contributing to meaningful global advancements.

Vision

Nobilis Global targets market leadership in alternative investments through alpha-generating strategies centered on world-class, proprietary deal flow and innovative structured finance solutions. We implement comprehensive risk management protocols across the investment lifecycle while leveraging fintech innovations to enhance operational efficiency and client reporting. Our approach aims to consistently outperform relevant benchmarks, adhering to regulatory standards and fiduciary best practices in portfolio management, with a focus on exclusive, high-impact investment opportunities.

Achieving the Pinnacle of Success

Transformative & High-Impact Opportunities

We prioritize investments with potential for significant societal and economic change, addressing complex global challenges.

Measurable Performance Metrics

We implement rigorous performance metrics to quantify both financial returns and broader impact, ensuring transparency and accountability

Strategic Innovation

We develop specialized expertise to tackle financially complex ventures with high potential, using investment vehicles that can position capital for long-term systemic change.

Risk Adjusted Return

We position clients for both investment opportunities and potential crises management by providing flexible investment structures that incorporate risk-mitigation resources, maintaining readiness for rapid deployment when needed

Solution-Oriented Neutrality

We maintain non-partisan approach, focusing on concrete problem-solving and cultivating diverse partnerships to achieve our investment goals.

Continuous Improvements

ISO-9001 (Quality Management System) is the substrate of our business system. With ISO-27001 (ISMS) and ISO-37001 (ABMS) functioning as specialized symbiotic layers, systematically enhancing our best practices.

Investing in a Sustainable Future

Nobilis Global aligns investment strategies with the United Nations Sustainable Development Goals (SDGs). We strive to bridge the gap between profitability and global sustainability by:

Identifying and investing in opportunities that advance SDG targets

Developing innovative financial structures that generate returns with impact

Collaborating with partners to accelerate progress towards the 2030 agenda

Together, we can demonstrate that responsible investing can yield both competitive financial returns and meaningful contributions to global peace and prosperity, addressing the challenges highlighted in the Capital as a Force for Good Report.